- Details

- Geschrieben von Joel Peretz

- Kategorie: Business

- Zugriffe: 4966

Startup Transitioning Beyond the initial Startup Stage

Putting the Building Blocks Together; Where Do We Pragmatically Go From Here?

The shelf company

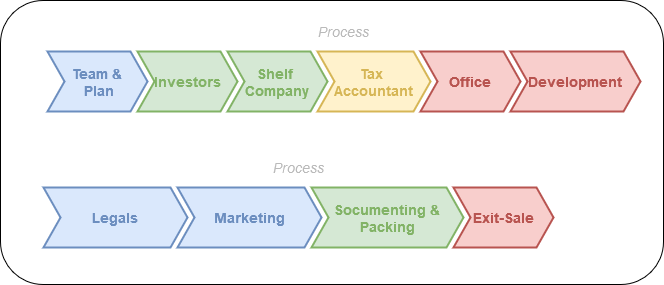

We have a solid idea and a clear vision. But what’s next? We know that starting a company from scratch is an option—though it can be error-prone and time-intensive—or we could acquire an already established “shelf company.”

A shelf company, often pre-registered and maintained without operations, typically comes with the essentials to get started. For example, if it’s based in Europe, it may already have a minimal startup capital deposited in a bank account and an associated debit card for transactions.

Adapting the Shelf Company to Fit Our Goals

Customizing a shelf company to align with our business goals involves several manageable steps:

- Purpose Adaptation: Adjusting the company’s purpose to cover broader or specific activities.

- Ownership Registration: Including the details of new owners or stakeholders.

- Name Change: Modifying the company’s name to match our brand identity.

These adjustments are handled through a notary, a legal professional responsible for formalizing such changes.

Are We Ready?

Even with a registered entity, the journey has just begun. Establishing the company or purchasing a shelf company is only the first step. From here, the real work of building processes, forming teams, and executing the vision starts.

Starting means expenses. We need a tax accountant and possibly an office with minimal setup. This is exactly why much needs to be clarified beforehand. We need to know and agree on a lot of things. For example, we all need to decide whether to open the company with basic calculations and known risks and metrics.

The next steps would be to create a business plan and prepare it, or to separate a presentation to deliver in front of investors and other stakeholders. It is also possible to create several presentation slides and use them according to the audience and scope.

This is not the case with the business plan. It is supposed to be the blueprint of the company. It is not only for presentation; it is actually for everything. It is used as a checklist before takeoff, for discussions, assessments, negotiations, as a reminder to check certain aspects, and for filling placeholders with information.

Following the outline and enriching it sufficiently with data and information might reveal weak points, mistakes, or areas where more research must be done. It is a working draft that, when reaching a certain stage, allows the company to start. Yet, it also serves as a working draft that will evolve into versions of the base copy as changes occur within the company

The Business Plan

It doesn't take much after starting to think about the necessities to recognize that, with limited resources, there is not much room for mistakes or large investments before many details are clear. The start requires clarity and transparency.

The Lego building blocks contribute to this; we need to minimize risks and uncalculated procedures and processes, tighten up contracts, and address hazards caused by invisible dangers and risks accordingly. To put it all on a sugar spoon and prepare to start, we list the main blocks that we need.

What do we need

A Shelf Company

This refers to a company that can be purchased and made legally operable within approximately two weeks. In Germany, for instance (this is not a recommendation but rather a reference point from which relevant keywords can be derived):

- Limited24: https://www.limited24.de/

- Youco24: https://youco24.de/en/german-shelf-companies/

- VRB: https://www.vrb-gmbh.de/en/shelf-companies/

- Foris: https://www.foris.com/en/shelf-companies/

A Notarial Service

To suit the needs of the local area.

A Tax Accountant

To suit the needs of the local area.

An Office That Is Scalable on Demand

- Fully equipped office with bookable services and spaces.

- Bookable offices to accommodate staff expansions.

- Short contract termination terms.

- International membership with bookable locations.

A Server and Data Platform

- Globally accessible 24/7.

- Scalable servers and capacities.

Computers and Office Devices

- Leased or rented as needed.

Phone and Internet Connection

- Centralized services.

- Individual personal communication and staff accessibility.

- Performance sufficient for teleworking and collaboration.

Workers

- Core staff.

- Additional staff as needed.

Software

- Personal.

- Global services like Google, Yahoo, etc.

- Open-source solutions where applicable and practical.

To make it clearer, we require company registration, associated services, computerization, communication systems, and a functional workspace.

All these elements involve costs. Each must be carefully researched and assessed, and where dependent on schedules or regulations, they should be documented and tracked meticulously. The question of how much these will cost, whether they are affordable, and when profitability might be achieved, is addressed through planning. The answers to these questions find their manifestation in the business plan document.

Remember, we are focusing on flexibility, scalability, and safety.

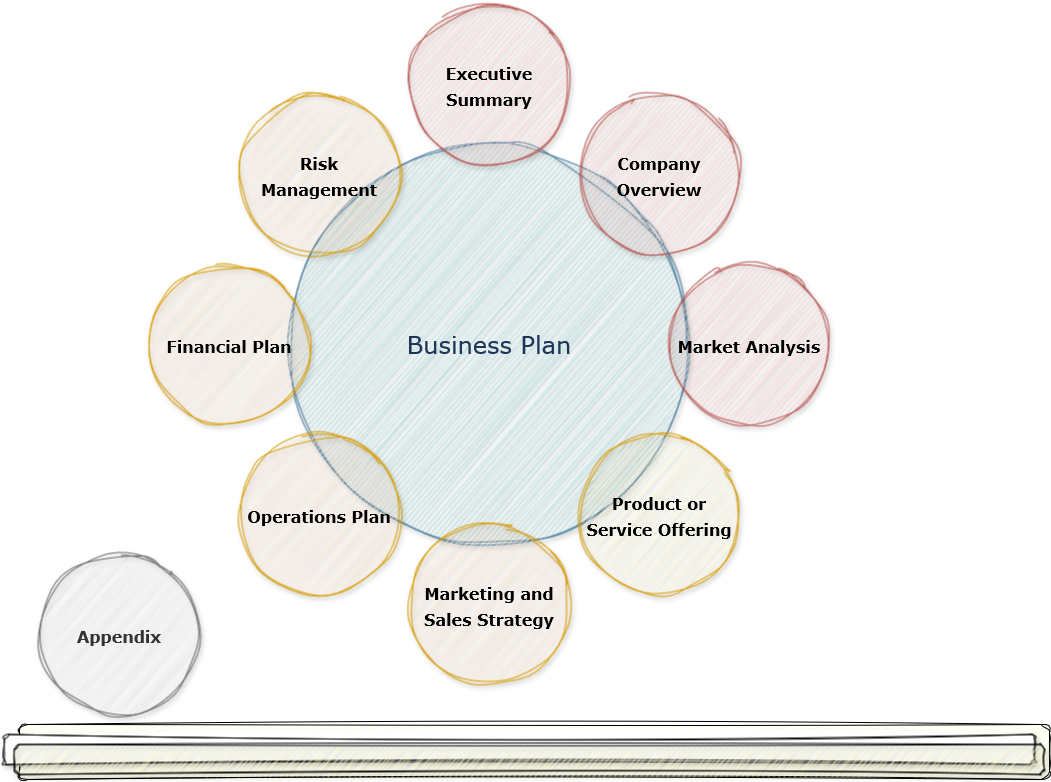

So, how does the business plan look in outline? Let’s take a look and briefly describe its content and purpose. Additionally, we’ll review where the building blocks fit in.

Business Plan

This is just a suggestion for a structure that would work for a software development project, for example. Some parts can be removed if they are not needed, or additional sections can be added later depending on the project's specific requirements.

- Executive Summary

- Objective: Briefly explain the purpose of the software and platform.

- Vision and Mission: Identify the problem it addresses and the ultimate goal of the platform.

- Market Opportunity: Provide a brief overview of the demand for scalable software solutions in the market.

- Product Snapshot: An outline of key features and functionalities of the platform.

- Key Metrics: Include anticipated timelines, budgets, and growth targets.

- Company Overview

- Background: Share details about your company, its history, and the founding team.

- Business Model: Explain how the platform will generate revenue (e.g., subscriptions, licensing, freemium).

- Unique Selling Proposition (USP): Highlight what makes your platform stand out from competitors.

- Market Analysis

- Industry Landscape: Provide market data related to the software and platform industry.

- Target Market: Define your primary audience (B2B, B2C, or both).

- Competitive Landscape:

- Key competitors in the market.

- Strengths and weaknesses of existing players.

- How your platform surpasses the competition (e.g., scalability, cost-effectiveness, innovative features).

- Product or Service Offering

- Product Overview: Describe the software and the scalable platform:

- Core features.

- Technical framework and architecture.

- Scalability components (e.g., cloud-native, modularity).

- Innovative technologies.

- Development Strategy: Outline your development roadmap:

- Phases: Concept, MVP (Minimum Viable Product), beta testing, full launch.

- Timeline for each phase.

- Future Enhancements: Discuss potential future features and expansion possibilities.

- Marketing and Sales Strategy

- Go-to-Market Strategy: Detail how you plan to introduce the software to the market.

- Launch campaigns, partnerships, and events.

- Pricing Approach: Define your pricing structure (e.g., subscription tiers, one-time fees).

- Customer Acquisition: Identify key marketing channels to attract users (e.g., SEO, social media, email campaigns, partnerships).

- Retention Strategy: Outline plans to retain customers (e.g., support services, loyalty programs, regular updates).

- Operations Plan

- Development Team: Describe the roles and number of team members.

- Technology Stack: Detail the programming languages, tools, and hosting solutions.

- Quality Assurance: Explain the testing and quality control processes.

- Infrastructure: Describe the server setup, cloud providers, and scalability options.

- Financial Plan

- Initial Budget: Outline costs for development, marketing, and legal fees.

- Revenue Forecasts: Estimate potential earnings from subscriptions, licensing, or other income sources.

- Break-even Point: Project when the business will reach profitability.

- Funding Needs: Specify the amount of investment required and its intended use.

- ROI Estimates: Provide a forecast of return on investment for stakeholders.

- Risk Management

- Technical Risks: Consider issues like downtime, bugs, and security vulnerabilities.

- Market Risks: Address challenges like competition or low user adoption.

- Financial Risks: Identify possible cash flow issues or cost overruns.

- Mitigation Strategies: Describe measures to minimize these risks.

- Appendix

- Financial Projections: Include detailed spreadsheets or charts.

- Technical Diagrams: Provide architectural blueprints or system overviews.

- Team Resumes: Attach CVs of key team members.

- Market Research: Share any relevant data or research sources.

This plan should be filled out iteratively. Once the idea is clear and well thought out, the first draft should take about an hour to complete. After that, certain sections will need to be prioritized, such as points 1 and 2, which will be used for the initial presentation. These sections are meant not only for investors but also for team members who will join the project. Throughout the process, it's essential to revisit and refine these parts, as they will evolve over time. It will be helpful to provide a printed version for review, so that specific questions can be raised. These questions can then be used to refine and clarify the plan for better understanding.

While many sections are intuitive, examples of how to fill them with data, tables, and diagrams are easily accessible. It's important to understand the process, but expertise in every section is not necessary. Once the idea is outlined and the presentation slides are prepared, the focus will shift to identifying which sections are critical and which are optional.

As a general rule, the more detailed the plan is—without being cluttered with unnecessary information—the more successful it will be. Use the necessary number of words to convey your ideas, but be very selective with your wording. It should precisely describe the key points. If an answer is not immediately available and requires further research, leave it blank with "TBD" (to be defined) or another suitable abbreviation. This will indicate that the section is still being worked on and hasn't been forgotten, but will be addressed in due course.

The use of versioning for all artifacts is essential for collaborative editing. It may also be necessary to track decisions made, document changes, and number data for various purposes such as backups, as well as presenting changes in the product. This process helps ensure transparency and accountability by capturing the underlying data and information that served as the foundation for decisions made.

Alright, we need a vision, and to describe it, we need notarial services and a shelf company. We also need a tax accountant and a lawyer to review contracts. A list of potential investors should be compiled, or we can announce our project within networks. We’ll need a flexible office that provides all the essentials for a startup.

Regarding the shelf company, we already have a few examples. But what about the list of investors? In every country, there are known venture capital firms that offer various models and terms. As an example, here are some in Germany and Israel:

Major Joint Venture Companies in Israel:

- OurCrowd - A leading global venture investing platform.

- Pitango Venture Capital - One of the largest VCs in Israel- https://www.pitango.com/

- Viola Ventures - Focused on transformative Israeli startups- https://www.viola-group.com/

- Startup Nation Central - Facilitating global connections for Israeli innovation - https://startupnationcentral.org/

- JVP (Jerusalem Venture Partners) - Specializing in technology investments -https://jvpvc.com/

- NFX Guild - Accelerating startups with venture capital backing- https://www.nfx.com/

Major Joint Venture Companies in Germany:

- High-Tech Gründerfonds - Supporting tech-focused startups- https://www.htgf.de/de/

- Rocket Internet - Backing innovative and scalable business models- https://www.rocket-internet.com/

- Project A Ventures - A VC and operational partner- https://www.project-a.com/

- Bavarian Israeli Partnership Accelerator (BIPA) - Facilitating Israeli-German collaboration- https://bip-accelerator.com/

- German Startups Group - Investing in promising young companies- https://www.german-startups.com/fur-aktionare/uber-uns/

- Next47 (Siemens) - Supporting industrial tech startups globally- https://next47.com/

We are looking for a solution for an office, and based on everything I’ve seen so far, my favorite option that meets all the necessary requirements is Regus. However, there are also other similar providers. What really stands out about Regus is its great flexibility, as it operates in many countries where members or clients can book workspaces and meeting rooms with the necessary equipment if required. Their office buildings are centrally located or placed in areas where business operations run more smoothly, such as near airports or in regions with a high concentration of companies. Regus, along with other providers in Germany, for instance, includes others as options like:

- Regus

As one of the leading providers of flexible office spaces, Regus offers a broad array of options, including private offices, co-working spaces, and meeting rooms, with locations in prime business areas and airports worldwide. Their membership system allows access to a global network of workspaces, making it suitable for businesses that require flexibility and scalability - https://www.regus.com/de-de - WeWork

WeWork is renowned for offering dynamic and flexible workspaces that cater to a wide variety of business needs. Their network spans multiple cities worldwide, offering both collaborative co-working environments and private offices. WeWork is particularly appealing to startups and businesses that thrive on community and networking opportunities-

https://www.wework.com/de-DE - Spaces

A part of the Regus family, Spaces delivers creative and modern office environments designed to foster collaboration. The brand targets professionals and teams looking for flexible, stylish workspaces. With locations around the globe, Spaces provides customized office solutions and versatile meeting areas-

https://www.spacesworks.com/ - LiquidSpace

LiquidSpace connects businesses with on-demand office spaces, enabling companies to rent meeting rooms or private offices on a short-term basis. This platform offers flexibility and scalability, allowing businesses to rent spaces as needed in various locations around the world-

https://liquidspace.com/ - Knotel

Knotel provides highly customizable office spaces designed to meet the unique needs of growing companies. Their focus is on scalability, offering tailored solutions that allow businesses to expand or modify their space as necessary. Knotel has a presence in major cities globally-

https://knotel.com/ - Business Center Network (BCN)

BCN offers a range of flexible office solutions, including serviced offices and conference rooms. Their network spans key business hubs worldwide, providing reliable, professional workspaces that can grow with your business-

https://bcnetwork.biz/

Now, it’s time to sit down and start writing. Writing. Writing. Writing. The cycle of writing, researching, and communicating will never truly end.

Good luck.

Glossar

| Term/Concept | Description |

|---|---|

| Shelf Company | A pre-registered, non-operational company that can be purchased to save time in company setup. Includes basic legal setup. |

| Notarial Services | Legal services provided by a notary, essential for formalizing documents like ownership changes and company registration. |

| Tax Accountant | A professional to manage company taxation, financial records, and compliance with local tax laws. |

| Flexible Office | Workspace solutions, often with short-term contracts, equipped with essentials for a startup (e.g., desks, meeting rooms). |

| Server/Data Platform | A globally accessible IT infrastructure enabling data storage, sharing, and scalability. |

| Business Plan | A detailed document outlining the vision, strategy, and financial plan for the startup. Serves as a blueprint for growth. |

| Trademarking | The legal process of securing the rights to a brand name, logo, or symbol for business protection. |

| Venture Capital Firms | Companies that provide funding to startups in exchange for equity or returns on investment. |

| Risk Management | Identifying, assessing, and addressing potential risks (technical, financial, market) to ensure business continuity. |

| Versioning | Tracking changes and iterations of documents, code, or plans to maintain organization and accountability. |

| Market Analysis | Researching the industry landscape, target audience, and competitors to define the startup's market position. |

| MVP (Minimum Viable Product) | An initial version of a product with just enough features to gather feedback and validate the concept. |

| Go-to-Market Strategy | A structured plan for introducing a product to the market, targeting customers, and gaining competitive advantage. |

| Lego Building Blocks | A metaphor for modular, scalable components needed for business operations, ensuring flexibility and efficiency. |

- Details

- Geschrieben von Joel Peretz

- Kategorie: Business

- Zugriffe: 5041

Exploring Collaboration and Startup Potential

Opening the Door for Joint Ventures and Future Growth Opportunities

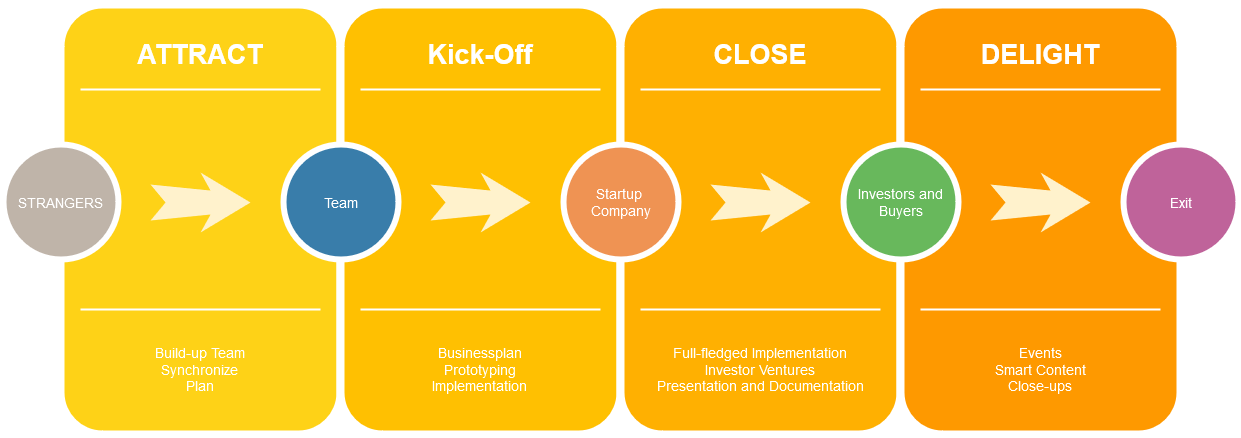

One of the biggest challenges in transforming an idea into a functional system or product within a startup lies with the participants—often referred to as the team. Team members must be open about their motivations and future plans, especially as the startup approaches success or expansion. Transparency in these moments is crucial for maintaining trust and alignment.

Investors, in particular, scrutinize the team closely. They assess not only the individual strengths but also the collective resilience of the group—how well the team can navigate discussions on critical issues that could shape the company's future.

Another key challenge is trust. Disclosing either too much or too little about the idea can lead to misunderstandings and potentially erode confidence among stakeholders. Similarly, the effort and commitment from each team member play a decisive role. A startup often lacks the resources to afford expensive services, but it is precisely these investments—both in time and expertise—that can determine its success.

Navigating these complexities requires a deliberate approach. Engage potential collaborators personally, discuss perspectives and motivations openly, and explore the "what ifs"—the potential scenarios, both positive and negative. This preparation not only builds a solid foundation for the company but also reassures investors. They will inevitably ask the hard questions, seeking to understand the solidity of the team and the security of their investment.

It is, of course, a significant advantage if one of the founders has experience in the functional area. Such experience enables the avoidance of many potential difficulties and hazards upfront by identifying the right path early on, saving precious time. This allows the team to focus on progress without needing to document every step in detail, especially when time resources are scarce. Known challenges can be acknowledged and deferred for deeper analysis and discussion at a more appropriate moment.

Specialists and experienced professionals inherently possess the foundational knowledge to anticipate and address issues that will inevitably arise. The better the idea and the smoother its implementation, the sooner external individuals and companies may express interest in profiting from it. This interest could include leveraging parts of the startup's work for entirely different purposes. Similar to a chemical production process, where a stage can be interrupted to extract a side-product for other applications, external parties might seek to repurpose foundational elements of the startup for their own benefit.

At its core, the strength of a startup lies in the unity and resilience of its team. A cohesive and aligned team forms the backbone of the company’s success. Conversely, if this unity is lacking—as numerous examples have shown—the team risks fracturing. Such division can lead to transformations that alienate the original vision, ultimately causing investors to withdraw their support and leaving the company vulnerable to closure.

I experienced this once firsthand when I assisted, free of charge and on a voluntary basis, a company that had the potential to become a giant but ultimately failed due to the aforementioned negative influences.

At the start, there is always the vision and the idea. Without these, nothing can begin. While the idea originates in the mind, it should be put on paper—even if it is summarized in just ten to twenty sentences. This description must be clear, concise, and precise.

Additionally, there might be secondary ideas or potential directions the concept could expand into. For instance, if the idea involves building a platform, it should be specified whether this platform is standalone or if it could serve multiple purposes.

If investors are to be brought on board, a business plan becomes indispensable, as does a well-prepared presentation of the idea. The amount of detail disclosed should strike a balance: revealing enough to inspire confidence but not so much as to expose proprietary aspects prematurely. Since the idea largely resides in the founder’s mind, the presentation can be adjusted and enriched on the fly, depending on the stage and the audience.

In the planning phase, the main baseline must remain at the forefront. This is the core reason for establishing the startup—the primary goal. This goal should culminate in a tangible version of the product or platform. The key functionalities to be offered should be clearly specified and listed.

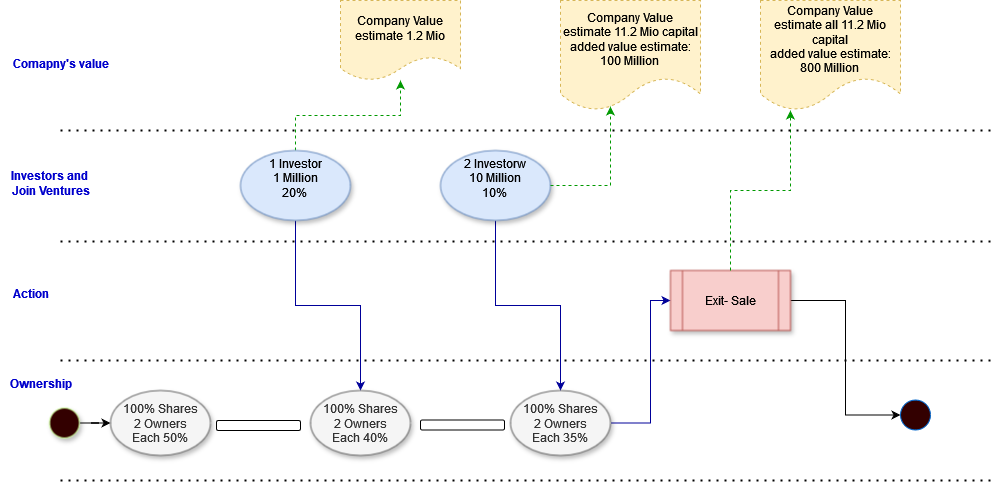

Additionally, the endpoint of this goal must be defined. If the objective is financial—for instance, to increase the company’s valuation and achieve an exit sale—this should be carefully calculated and justified. Why would an individual or company be willing to buy it for a specific sum? What revenue or other benefits would they gain? These questions must be addressed clearly and convincingly.

To explain it simply, as I understand it, the value of a company is primarily based on its capital and inventory—excluding physical assets like software not part of the initial capital. When investors come in, they typically acquire a larger share for a smaller investment, as the risks are higher at the early stages. As more investors join, the share each new investor receives becomes smaller, but their contribution is larger due to reduced risks and the increasing visibility of potential success. It's like taking a slice of a cake that's nearly finished baking.

Eventually, as the project becomes successful, it may not require additional investors because the business can fund itself. For example, by generating large-scale network traffic or through other monetization methods. At that point, there are likely many other options and strategies that I am not fully familiar with yet.

The distinct components of the implementation should be clearly identified—this is, after all, a fundamental step in defining the architecture’s concept. Additionally, ideas for branching off these components into separate side-products should be explored. The stages of development and their versions should also be documented, as this will form a critical part of the business plan.

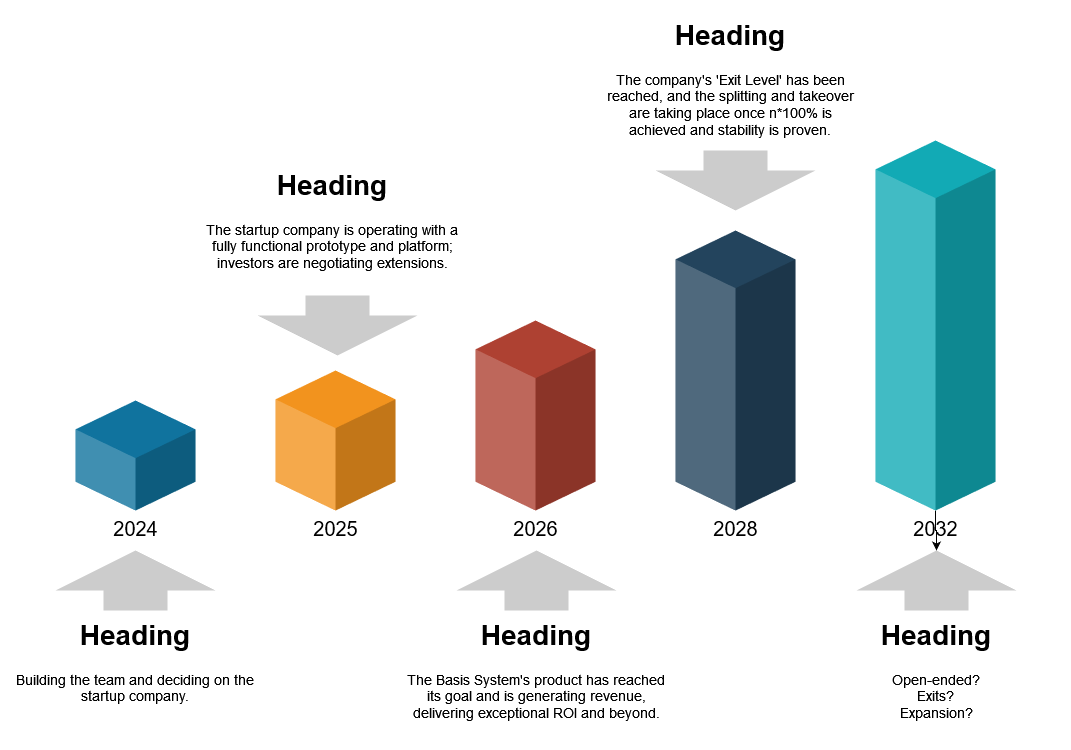

Here’s how the process might look, based on logic, knowledge, and experience:

- Team Formation:

The team members meet to get to know each other, understand their intentions, and align their goals. - Initial Setup:

A minimal business plan is drafted, and a collaborative backend platform is established to facilitate teamwork. - Prototype Creation:

The business plan is refined, and a minimal viable prototype is implemented. - Implementation and Development:

The project progresses through its implementation phase until the primary goal is achieved. - Potential Exits and Iterations:

Along the journey, one or multiple exits—whether final or extended—may take place. Any new ideas that emerge during this process can then follow the same structured approach.

Back to the idea: Sure, caution is necessary, but there's no way around it when transitioning from theory to implementation — it's essential to know with whom you're working. Everyone needs a certain level of security, but it must align with the stage of the process. Many entrepreneurs start alone until they reach a presentable level, at which point they call for others to join. However, bringing people on at that stage tends to be more expensive. The risks are lower, and the outcome is more secure.

Since I’ve also had an idea over the last few years, it can be discussed as part of the intention to promote cutting-edge technologies and contribute to the facilitation of systems with advanced automation.

When considering a startup, not only the vision and the idea are central—though they are the very beginning and the source of inspiration—but practical aspects will emerge immediately. Questions such as how to communicate securely, how to share and process documents, and who will book and manage server resources need answers. If it’s a cloud service, whose credit card will be used?

These considerations are not meant to discourage or dampen the excitement and motivation but to highlight the importance of careful planning right from the first step. And that first step is communication: talking things over, comparing ideas, and ensuring everything aligns.

If you want to be an entrepreneur, join forces with experts and heed their guidance. Otherwise, they might hesitate to let you lead, especially if you’re pushing into uncharted territory with risks that go beyond what is reasonable—risks they may have already encountered and learned from, particularly in professional IT or functional areas.

If you have an idea or are considering joining one, start communicating in a way that ensures all participants understand their roles and positions from the beginning. Without this clarity, the collaboration might fail. Alternatively, if you choose to start alone, you’ll need to take on the risks yourself and outsource critical skills where your expertise falls short. However, this approach can be more expensive and may expose your idea to theft or misuse if it isn’t protected by legal measures.

| Term | Definition |

|---|---|

| Startup | A newly established company, typically with a focus on high growth potential and innovation. Startups often operate in developing markets or emerging industries and face high levels of uncertainty. |

| Joint Venture (JV) | A business arrangement in which two or more parties agree to pool their resources and expertise for a specific project or business activity, sharing both the risks and the rewards. |

| Investor | A person or organization that allocates capital to a business venture in exchange for equity, interest, or another form of return on investment. Investors play a critical role in funding startups. |

| Equity | Ownership interest in a company, typically represented by shares or stock. Equity is often given to investors in exchange for funding the company. |

| Exit Strategy | A plan for how an investor or entrepreneur will sell their stake in a company and realize profits. This can include selling the business to another company (acquisition), going public (IPO), or other methods. |

| Prototype | An early model or version of a product built to test and validate the concept. In the startup context, a prototype demonstrates the core functionality of the product or service before full-scale production or development. |

| Minimal Viable Product (MVP) | The simplest version of a product that allows the business to test its concept with users and get feedback with minimal resources. The MVP is essential for startups to determine whether there is a market for their product before making further investments. |

| Business Plan | A formal document outlining the goals of a business, the strategy to achieve those goals, and the financial projections. It is essential for both guiding the startup and securing investments. |

| Value of the Company | The worth of a company, typically based on its assets, revenue, and market position. In the startup world, this also includes intangible assets such as intellectual property and potential for growth. |

| Revenue Generation | The process of earning income through the sale of products, services, or other business activities. In a startup, revenue generation is key to achieving profitability and sustaining operations. |

| Scaling | The process of expanding a business to meet growing demand, typically involving increasing production capacity, expanding into new markets, or hiring more staff. In the context of a startup, scaling is crucial for long-term success and attracting investors. |

| Monetization | The process of turning a business idea or product into a revenue-generating activity. For startups, monetization can take many forms, including direct sales, subscription models, or advertising. |

| Seed Investment | The initial capital used to fund a startup at its early stages. This funding often comes from the founders, angel investors, or early-stage venture capitalists. |

| Exit Sale | The sale of a company to another entity, often representing the culmination of a startup's journey. This may be an exit strategy for the company’s founders or early investors. |

| Due Diligence | The investigation and evaluation of a business opportunity before making an investment. It involves assessing the startup’s financial health, market potential, and risks. |

| Stakeholders | Individuals or groups that have an interest in the success or failure of a business, such as founders, investors, employees, and customers. Stakeholders can impact the direction and operation of the startup. |

| Exit Route | The pathway a startup follows to eventually exit the market, which could include acquisition by a larger company, an initial public offering (IPO), or other methods of selling the business. |

| Transparency | Open communication and sharing of relevant information within a business. Transparency is crucial for building trust among the team, investors, and stakeholders, and for avoiding misunderstandings. |

| Risk Mitigation | The strategies used to minimize the potential risks in a business venture. For startups, this involves careful planning, gradual scaling, and securing adequate investment. |

| Burn Rate | The rate at which a startup is spending its capital before generating any revenue. A high burn rate is common in the early stages but can lead to problems if not managed properly. |

| Business Model | The plan implemented by a company for how it will generate revenue and make a profit. Common models for startups include subscription, freemium, and advertising-based models. |

| Stakeholder Alignment | Ensuring that all key participants—such as founders, employees, and investors—are on the same page regarding the company’s goals, strategies, and operational methods. |

| Scaling Up | The process of growing a startup’s operations to handle a larger customer base or market share. Scaling typically involves investing in infrastructure, hiring new employees, and expanding marketing efforts. |

- Details

- Geschrieben von Joel Peretz

- Kategorie: Business

- Zugriffe: 5197

We Wait Until the Ground Freezes

Turning Tides: From Struggles to Strategic Opportunities

In stable and economically prosperous times, we often build groups based on somewhat superficial communication. Collaboration and cooperation are essential, and this is where group dynamics become the strongest. Interestingly, it's not always direct skills that determine the distribution of power within these groups. Instead, it’s often the ability to project confidence and openness that draws more attention and significance in the work environment. Some individuals, on the other hand, choose a more resilient and inconspicuous path, maintaining a low profile to avoid higher expectations or increased responsibilities. There are countless shades of gray between these extremes.

When these groups are companies, and the circumstances shift to a more challenging economic period, the dynamics change. Companies need to become highly efficient or adjust by either hiring more skilled resources or letting go of those who add little value. Often, both happen simultaneously. The least productive members or those perceived as a risk to stability are usually the first to be let go.

When facing a tough situation or when the tension between fight and flight is high, we can choose to "fly forward" and confront the challenge head-on. This typically happens when there are limited options, but we’re still compelled to act due to a specific reason. If freezing is an option, it might serve as a temporary solution until remaining still becomes impossible. At that point, we need to take a decisive step toward the impending threat or danger. Interestingly, when we finally make that move, it often seems like the most obvious thing to do. With the right confidence, what initially appeared as risky becomes far less daunting.

When there’s a lot at stake and freezing is no longer viable, taking that bold step forward often turns out to be the wisest choice.

Once upon a time, I was driving a car through the vast Romanian landscape along the Danube River, heading toward Constanța. It was winter, but the days were unusually warm, and the light rain falling on the thin layer of snow was making the ground on the flat fields beside the road muddy and slippery. I had to make a quick stop and turned the car to a halt, but ended up a meter or two too far off the road. Suddenly, the car got stuck in thick mud. Up until that point, the mud had been hidden beneath the melting snow, making it hard to see.

With no road service available like in Germany, I was left to find a way to pull the car back onto the road. The struggle was exhausting, especially since I didn’t have any tools or equipment to help. After an hour of trying, I had to admit to myself that the situation was quite unpleasant.

I had certainly faced worse situations in life. But this one puzzled me because I never took such roads without proper equipment. Yet, life has a way of throwing unexpected lessons your way. It was only a couple of days before New Year’s Eve, and a sense of desperation started to creep in. Normally, I’m the one to handle complicated or dangerous situations, but this time, I noticed the concerned expression on my girlfriend’s face. She was deeply immersed in her physics studies, always thinking analytically.

After a moment, I asked her if she had any ideas. She looked at me calmly and said, “We can just wait until night. The ground will freeze, and then we can simply drive the car out. Until then, we can stay inside, enjoy some music, and eat our sandwiches.”

Her words struck me. This was exactly what I usually do—pull myself out of a stressful situation, assess it calmly, and suddenly see new options.

In the economy, those of us who took the greatest risks—like freelancers and senior management—are now left exposed to those within companies who mostly kept a low profile. In challenging and turbulent times, these individuals often find themselves in safer, more stable positions. Perhaps there is a quiet sense of revenge, an attempt to reconcile a guilty conscience for having relied on the efforts of those who took the risks during prosperous times. Just maybe.

But after reading the numerous comments and subtle calls for help from skilled and experienced professionals, I’m coming to a conclusion: we have stayed in one place for too long, waiting for circumstances to improve. We can’t keep hoping that the night will come and the ground will freeze; we need to push forward. There’s no retreat now, as our path back is blocked by major events like the energy crisis, political turmoil, widespread fears, and those who capitalize on these fears. A generation that dismisses others simply because they are in need or have reached a certain age only adds to the complexity of this situation.

In the near future, I will outline several options and make a call to action. If no company is willing to take us, we will create one ourselves. By combining efforts between North America, Israel, and Germany, we can pool our skills and resources. My vision is inspired by a former colleague who successfully started a system based on ‘points’ earned for contributions, which were later converted into financial rewards or positions. The formal structure needs to be developed, and I’ll share more details on my homepage soon, including a link here.

In the meantime, if you’re a specialist or expert in marketing, recruitment, development, or management, and feel that your age might be a factor in frequent rejections or project cancellations, consider reaching out to me. We can connect via Zoom, Skype, Google Meet, MS Teams, Telegram, phone, or email. But first, let’s connect here on LinkedIn and continue exploring opportunities while keeping a fresh breeze in our sails with new ideas and creative solutions.